The best way to predict the future is to invent it via cutting-edge technologies. The accurate crude oil price forecasting is mandatory for enterprises to grow in this meantime where the recession has altered everything and ruined the way businesses operate. Now, a question arises, why is crude oil so important? In short, its shortage can annihilate even the global economy.

The unrefined or raw petroleum is called crude oil when refined, it yields a lot of byproducts, hydrocarbons, and their derivatives. As the oil and gas sector is competitive, their pricing depends on limitless factors, which can be internal or external.

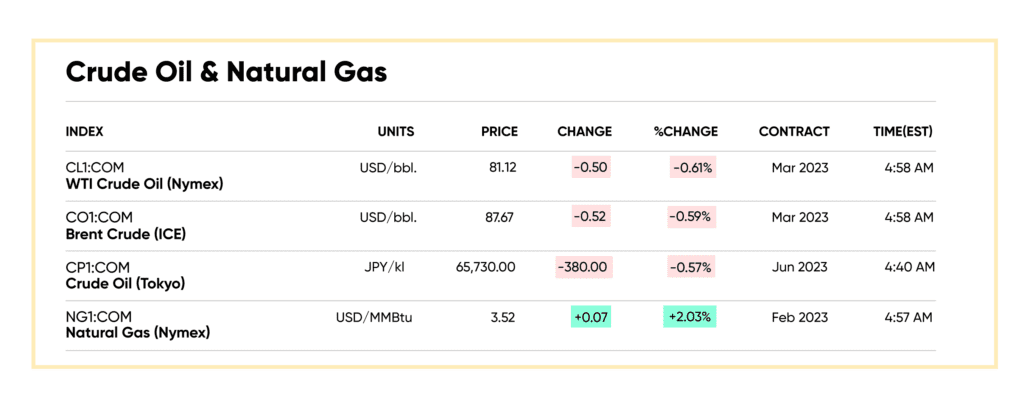

In this article, we will elaborate on some challenges to crude oil price forecasting and solutions to these challenges from oil and gas Industry experts. Let’s start by elaborating on current crude oil prices globally.